how to pay indiana state withholding tax

To get started click on the appropriate link. Know when I will receive my tax refund.

This form should be completed by all resident and nonresident employees having income subject to Indiana state andor county income tax.

. Employers required by the Internal Revenue Service to withhold income tax on wages must register with the Indiana Department of Revenue DOR as a withholding agent. Find Indiana tax forms. You may also need to complete the FT-1 application for motor fuel taxes including special fuel or.

Apply online using the IN BT-1Online Application and receive a Taxpayer ID number in 2-3business days. To check the status of your Indiana state tax refund go online to the INTIME portal or call 317-232-2240 the automated refund line. The withholding must be in whole dollars.

In addition the employer should look. INtax - Log In or Create new Account INtax will continue. Ad Real prices from local pros for any project.

To file andor pay business sales and withholding taxes please visit INTIMEdoringov. Income Tax Information Bulletins which may be of assistance with withholding tax. Find pros you can trust and read reviews to compare.

However as of 2013 all Indiana. To register for withholding for Indiana the business must have an Employer Identification Number EIN from the federal government. To file andor pay business sales and withholding taxes please.

This will be your Location ID as listed on your Withholding Summary. Make a payment online with INTIME by credit card or electronic check. Indiana has a flat state income tax rate of 323 for the 2020 tax year which means that all Indiana residents pay the same percentage of their income in state taxes.

To register for Indiana business taxes please complete the Business Tax Application. Indiana Department of Revenue is launching a new e-services portal to manage your corporate and business tax obligations. Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill.

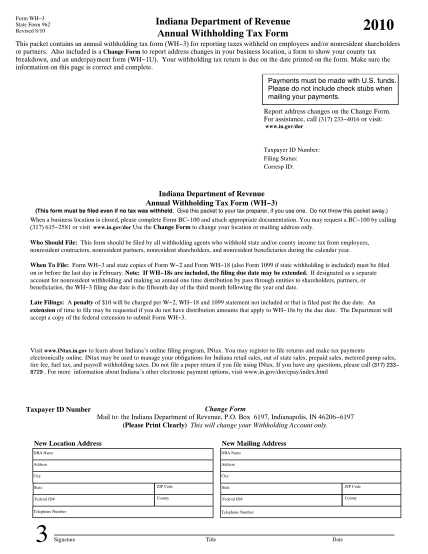

Formerly many Indiana withholding tax payers could pay on paper by sending in Form WH-1 Indiana Employers Withholding Tax Return with a check. Reporting is electronic via INtax. Prices to suit all budgets.

You must specify the dollar amount of State tax you want withheld from your monthly payments. Print or type your full name Social Security number. As previously stated Indiana is a state that allows you to use Form W-2G for your state income tax return as well.

State Tax to Withhold 61731 x 0323 1994 County Tax to Withhold 61731 x 01 617 Note. The minimum amount we can withhold for State. To do so transfer the amount from Line 7 of your Federal 1040 to Line 1 of.

Youll need to provide your Social Security. The WH-1 is the Indiana Withholding Tax Form and is required for any business that is withholding taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Indiana businesses are required to withhold state and county income taxes for employees report withholding and pay withholding periodically.

16 Printable Indiana State Tax Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Peoplesoft Payroll For North America 9 1 Peoplebook

16 Printable Indiana State Tax Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller

State W 4 Form Detailed Withholding Forms By State Chart

State W 4 Form Detailed Withholding Forms By State Chart

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Irs Forms Fillable Forms 1099 Tax Form

Understanding Your W 2 Controller S Office

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding